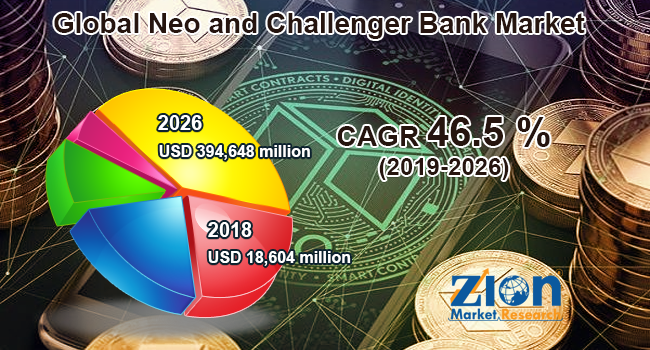

Neo and Challenger Bank’s Market is expected to rise by a double digit CAGR of 46.5% in 2019-2026, worth USD 186 billion. The favourable provisions from several government agencies worldwide as well as the benefit of Neo Banks to customers in the form of fast account opening are factors that influence the growth of the Neo & Challenger Banks industry. Another driver to the growth of the Neo and Challenger banks market is the growing penetration of the Internet globally, especially in developing nations such as China and India.

Millennials, micro, small and medium-sized enterprises (MSMEs), erratic sales and profits, the introduction of emerging technology and growing consumption are among the catalysts for neo-bank performance. In order to allow neo banks to infiltrate smartphones and the internet more extensively. The familiarity of consumers with digital technologies and basic information about financial goods and services is another aspect. However, due to the limited product scope offered by Neo Banks, demand expansion could be restricted.

Characteristics and services such as simplicity, cost-effective multi-bank and financial features, and personalization are some of the main drivers for neo-banks worldwide. A further consideration is that FinTechs are designing niche solutions that concentrate on blue colour jobs, thereby pushing the underserved requirements of thin-file MSMEs. Neo banking will act as an extension for initiatives implemented with other financial institutions to overcome the complexities of financial inclusion and banking bundling, such as programmes such as opening immigrator accounts, enabled by new on boarding protocols not focused on conventional identity documents.

The rivalry between conventional banks, new-aged financial developments, technology companies and non-bank entrants has been increasing, and it remains to be seen if the demand is very much adequate for neo-banks to expand sustainably and equitably. The fundamental determinants of their performance would be how neo-banks address vital challenges in the fields of enforcement and policy, data and cyber, unified incorporation of APIs and extension of goods and operation.

Challenger Bank Market:

Challenger banks are existing entities that work on the market with a total banking licence. These banks offer services including credit, brokerage and loan deposits, checking and investing accounts, electronic banking, credit cards, mobile banking etc. (retirement investments, product protection, and bit coin purchases and sales). These banks are increasingly confronting conventional banks through the creativity and convergence of their product offerings of many innovations. Take innovative features, real time technologies and consumer oriented goods and services into the banking sector together with new and competitive banks raise threats for existing conventional banks in the market.

The market is powered by higher interest rates offered to clients over conventional banks, funding for government and regulatory activities and greater functionality given by mobile apps. But the acquisition of customers and their viability digitally limits the growth of these start-up banks. In addition, the neo and demanding banking market should be profitably able to extend its business by improving online supply to the unbanked population in developing economies. Additionally, the growth of businesses, the creation of the current banking portfolio, the combination of products and the provision of custom solutions remain some other areas of focus for those Fintech banks in coming years.